There’s no question that the financial period-end close, for most companies, is plagued by challenges that compromise the accuracy, timeliness, and cost of closing the books. Internal and external stakeholders, along with financial teams, suffer from the complexity and disconnectedness of most close processes. Nonetheless, there are key improvements teams can make to substantially reduce time and effort. They center on data processes and automation, increasing access, and reducing manual data interaction so that business decisions can be made on time and with confidence—all while finance teams continue with value-add work.

Major Challenges

Closing books in a typical business is a complex and tedious process of data extraction, validation, and entry. It means long hours—often days—of labor. Companies with disparate systems and/or divisions tend to grow data silos, where access is limited or difficult for many or all stakeholders. This leads to bottlenecks that cost time, and the potential for inaccuracies/errors as manual interventions abound in the process.

Formerly a problem mostly for larger regional organizations, the pain of collaborating on financial close registered for almost everyone in the last two years as remote work became the new norm. In a process rife with emailed spreadsheets (and thus multiple sources of truth), validation, security, compliance, and time all suffer.

So, what’s the fix?

Consolidate, Consolidate, Consolidate

With access to disparate systems being a defining problem for financial close (and many other data-reliant processes), data consolidation remains one of the most impactful ways of improving financial processes. Because data lives in so many different systems (and the number is growing), companies need a centralized place to aggregate important queries and connect the most used reports.

Consolidation breaks down bottlenecks and helps bridge the gaps between software systems that all contribute to financial processes like the close. Materially, consolidation might mean spinning up a data warehouse to process and store key data from different systems, working with APIs to bring highly specified stats from multiple systems together, or some combination of data strategies designed to create and maintain a single source of truth. But in any case, the overarching goal is to eliminate or reduce the need to access multiple systems and sources and, instead, bring all relevant data directly to its endpoint.

Get Your Reports Connected

Reporting is perhaps the major bottleneck in the financial close. Getting the most ubiquitous reports connected to source data and to each other has far-reaching benefits in terms of speed, accuracy, and security. Connected reports act as interfaces to data, rather than strictly static endpoints.

Whereas a typical static spreadsheet presents a liability from an IT/security perspective – data living only in spreadsheets prone to corruption and loss—getting the needed data out of the spreadsheet and into a database connected to the spreadsheet loops the endpoint back into a rigorous, IT-friendly process. Additionally, spreadsheets as interfaces allow for collaboration, a reduction of reports in general, and the elimination of liability inherent to static spreadsheet files.

Endpoint integration of this nature will profoundly improve all aspects of the financial period-end close. Since reports become interfaces, rather than files, no one person holds sole access to a particular data set, and all accounting functions are shared by anyone interfacing with data during close. In a very real sense, your spreadsheets become applications that all your key players can access, so data stays fresh, and the entire close process plays out in real-time with real-time data.

Automate—It’s Not Just a Buzzword

The lion’s share of labor during close is manual data manipulation: exporting, copy/pasting, and importing data back. By virtue of making the improvements mentioned above, much of that work will be automated. When reports have a bi-directional connection to source data, import/transform/export functions are in essence now automated. And when key source data gets transformed and consolidated into a single source of truth, there are several actions within those processes that are done behind the scenes simply by an analyst pulling the data into the spreadsheet.

The additional benefits of automating these data-heavy tasks are many. By defining close processes more rigorously through automating things like data extraction, report format, and data upload, a huge accuracy risk is mitigated, and a truly governed financial process starts to emerge. That makes insight more reliable, mistakes more traceable, and overall data processes infinitely more trustworthy.

So, What Does It Look Like?

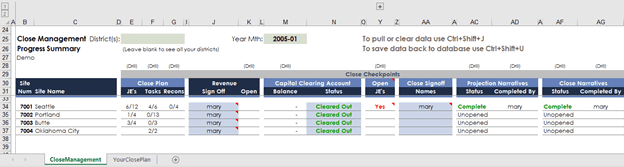

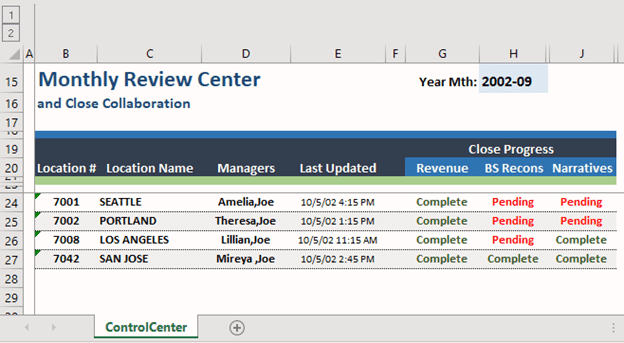

Interject has profoundly improved financial close speed and accuracy for companies with up to and beyond 1,000 users by consolidating data and data access, and getting key reports connected. For example, our Close Dashboard (a seminal tool in our overall close management offering) gives robust oversight of the entire connected close process and encapsulates the value of the strategies detailed above.

Because all key reports are linked to a central data source, and thus to each other, the Close Dashboard offers a view of the financial close progress on a rolled-up basis—showing what’s ready for review, what’s still pending, and what’s completed across any number of regions or divisions. More than that, it governs the entire close by tracking who made what changes and when, and who signed off on those changes, offering full accountability to the close process and eliminating questions and risk.

It’s easy to see with this one example how connecting an entire suite of reports to each other and to source data improves collaboration and reduces liability. Through the Close Dashboard, a manager can not only see what’s done and what’s left, they can also drill into the detailed reports of any division or region to see what their teams are submitting or to track anomalies.

In the truest sense, Interject transforms otherwise static spreadsheet files into tools that interface with source data, so the reports don’t have to be saved or emailed, and so the data doesn’t live in the sheet but is instead only displayed there. As the data is uploaded by financial teams through these spreadsheet interfaces, managers can trace it in real time with the dashboard. Just like that, the financial period-end close is integrated and automated.

Of all back-office functions, the financial period-end close is among the most important and the most painful. This is made exponentially more difficult as companies increase in size and breadth. That makes it a prime candidate for process transformations. Financial close is also one of Interject’s most impactful use cases, as the ability to scale financial processes and remain fast and nimble becomes a reality without requiring users to adopt a new interface. With all this in mind, approaching the close as a first or key automation project promises significant returns and, maybe inarguably, a much happier staff.

Author:

Bill Erickson is Interject’s director of communications. He’s an avid strategist and a professional writer. His passion for story and value gives our team and our clients a voice.